SECURE 2.0: Changes Going Into Effect in 2024

Passed in 2019, the SECURE Act was the most substantial retirement legislation in over a decade. It contained important changes designed to help investors save more and be better prepared for the future.

To build on the popular aspects of the SECURE Act, Congress, late last year, passed SECURE 2.0.

Although the new laws will impact all savers in some ways, navigating all of the changes is a bit like putting a puzzle together; so we thought we would outline the key highlights of what provisions of SECURE 2.0 go into effect next year.

New 2024 Retirement Savings Changes

Retirement Plans and Personal Emergencies

Distributions from retirement plans for personal emergencies will be allowed penalty-free. You will be allowed one distribution per year of up to $1,000, with the choice to repay the distribution within 3 years.1

Individual Retirement Account (IRA) Catch-Up Contributions

IRA catch-up contributions, currently limited to $1,000 for people aged 50 and over, will be indexed to inflation, meaning they could increase yearly based on federally determined cost-of-living increases.2

Potential Retirement Incentives for Employees with Student Debt

Employers will be able to “match” employee student loan payments with matching payments to a retirement account, giving workers an attractive employee benefit and an extra incentive to save for retirement while paying off educational loans.2

New: Rollovers from 529s to Roth IRAs

Tax-free and penalty-free rollovers from 529 accounts to Roth IRAs will be allowed under certain conditions. Beneficiaries of 529 accounts who did not use all of the education assets will be permitted to roll over up to $35,000 (lifetime limit). This will be subject to Roth IRA annual contribution limits, and the 529 account must have been open for more than 15 years.2

Roth Plans and RMD Changes

Roth accounts in employer retirement plans will be exempt from the RMD requirements.3

Once you reach age 73, you must begin taking RMDs from a traditional IRA under most circumstances. Withdrawals from traditional IRAs are taxed as ordinary income and, if taken before age 59½, may be subject to a 10% federal income tax penalty.

A 529 college savings plan allows individuals to save for college on a tax-advantaged basis. The state tax treatment of 529 plans is only one factor to consider before committing to a savings plan. Also, consider any fees and expenses associated with a particular plan. Whether or not a state tax deduction is available will depend on your state of residence. State tax laws and treatment may vary. State tax laws may be different from federal tax laws. Earnings on nonqualified distributions will be subject to income tax and a 10% federal penalty tax.

To qualify for the tax-free and penalty-free withdrawal of earnings, Roth IRA distributions must meet a 5-year holding requirement and occur after age 59½. Such withdrawals can also be taken under certain other circumstances, such as the owner’s death. The original Roth IRA owner is not required to take minimum annual withdrawals.

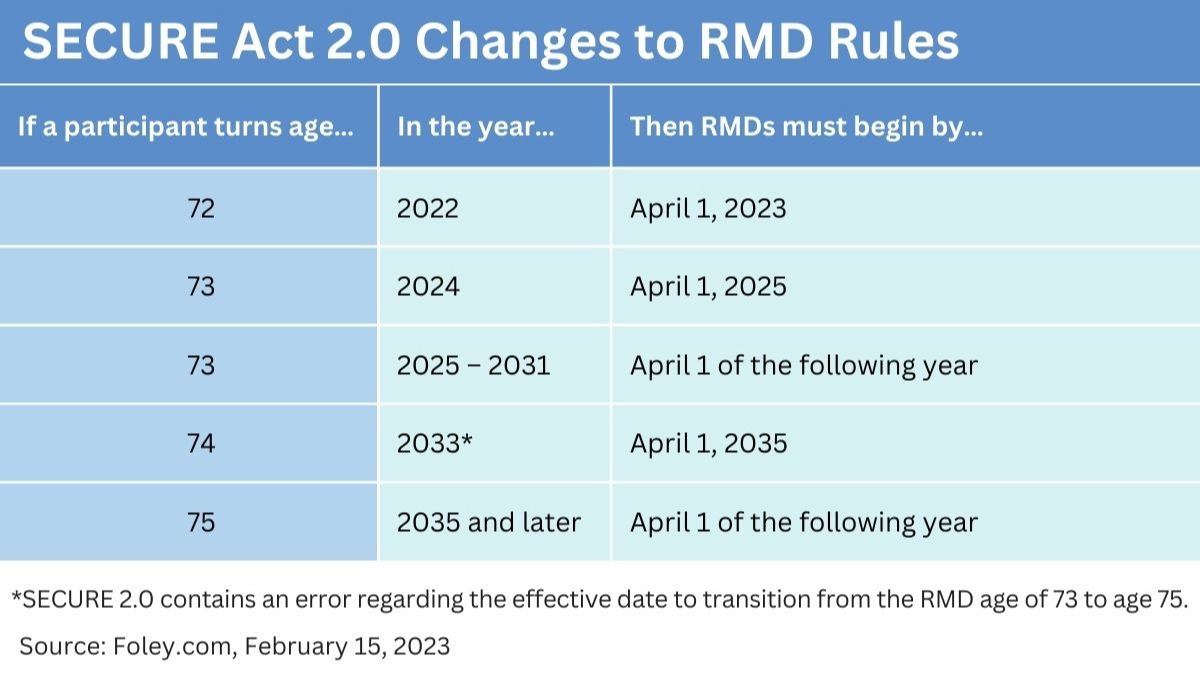

RMD Changes to be Aware of

RMD changes in both SECURE and SECURE 2.0 may impact retirees, their spouses, and beneficiaries. The original SECURE Act adjusted the distribution rules, including changing RMDs from age 70½ to 72.

SECURE 2.0 makes even more changes to the RMD rules.3 The RMD age changed to 73 years in 2023 and will change to 75 years in 2033. The chart below highlights these changes.4

Another provision that clients are just getting used to is changing the period over which beneficiaries may receive payments, including a new 10-year payment period for designated beneficiaries.

The SECURE Act made significant changes by requiring that most beneficiaries must draw down their inherited IRA within 10 years after the IRA creator’s death. Beneficiaries can no longer “stretch out” the payments over their life expectancies. Exceptions to this rule have been carved out for spouses and minor children beneficiaries. Adult children, grandchildren, and most other designated beneficiaries are subject to the 10-year rule, meaning they must complete the distribution in a set timeframe.4

Professional Guidance

This is a lot to absorb, for sure! There are nuances and complexities to SECURE 2.0 that may impact your retirement preparation and estate strategies. Some changes may be for the better, whereas others may create additional hurdles for you and your heirs. As with most financial issues, it all depends on your situation and circumstances.

We have taken the time to understand the range and scope of the new rules and can provide additional guidance if you are looking for clarification. We also have additional resources that can help if you have more nuanced questions. As always, we are here to help.

1 Ascensus.com, May 24, 2023

2Fidelity.com, April 2023

3 ASPPA.org, January 11, 2023

4 Foley.com, February 15, 2023