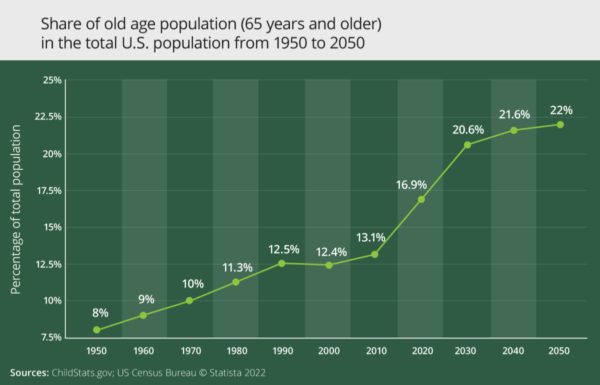

Senior care costs can be overwhelming, particularly when long-term care is required due to illness or medical conditions. With the number of seniors in the U.S. expected to rise exponentially by 2030, it’s crucial to be prepared for these expenses. In this blog post, we’ll explore the various costs of senior care and provide tips and resources for your financial strategy.

Understanding the Limitations of Medicare and Supplemental Health Care Insurance

Medicare, the federal health insurance program for seniors, has limitations regarding long-term care coverage. It only covers up to 100 days of skilled nursing care under specific conditions and doesn’t cover assisted living costs. Many seniors opt for supplemental insurance policies, also known as Medigap insurance, to bridge this gap. These policies can range from $50 to $300 per month, depending on coverage limits and deductibles. Seniors who cannot afford health care costs may qualify for state Medicaid programs; however, Medicaid has strict income and asset limitations, and a five-year lookback period for asset transfers.1,2

Exploring the Costs of Nursing Homes, Assisted Living Facilities, and In-Home Care

The long-term expenses associated with nursing home care hinge on various factors, e.g., geographical location, chosen provider, intended duration of stay, and any specialized services required. In some instances, facilities offer all-inclusive rates, whereas others may impose additional fees for specific services, encompassing physical therapy, speech therapy, and memory care.

In recent years, nursing home rates have experienced a significant surge, a pattern that is expected to persist over the next several years.

If current projections prove accurate, the monthly expense for a semi-private room in a nursing home will exceed $10,000 by 2030, reflecting an increase of approximately one-third. As for private rooms, anticipated annual costs already have surpassed the $100,000 threshold. To understand this trend better, consider a comparison of historical, contemporary, and projected annual expenses:

Below are some national average costs for long-term care in the United States (as of 2020).

- $119 a day, or $3,628 per month for care in an assisted living facility (for a one-bedroom unit)

- $20.50 an hour for a health aide

- $20 an hour for homemaker services

- $68 per day for services in an adult day health care center

Administration for Community Living, 2023

What is long-term care insurance?

Considering that you’ll need to pay out-of-pocket for long-term care services not covered by Medicare or a private insurance program, you may want to consider enrolling in a long-term care insurance plan. Long-term care insurance is designed to cover long-term care needs, services, and support arising from a chronic illness. As a type of private insurance, you typically purchase it for yourself, just like you would individual life or health insurance.3

Policies can cover many long-term care services and expenses, including in-home care, rehabilitation, and end-of-life hospice care. Generally, you become eligible for benefits once you no longer can perform a set number of activities of daily living (ADLs)––e.g., bathing, dressing, eating, using the toilet, getting in and out of beds and chairs, and managing incontinence––or become cognitively impaired.

Generally, a long-term care policy helps cover the costs of care needed to help navigate ADLs in a nursing home, assisted living facility, or home. Policies also can cover rehabilitation services, e.g., physical therapy and end-of-life hospice care. You must require help within at least two ADL areas to receive benefits under most policies. A healthcare provider also must sign off that you require these services for over 60 days.4

How much does long-term care insurance cost?

Several factors affect long-term care insurance costs and availability, including age, health, and coverage amount. Long-term care policies also have expenses and limitations. You should consider determining whether you’re insurable before implementing a strategy involving long-term care insurance. Any guarantees associated with a policy are dependent on the issuing insurance company’s ability to continue making claim payments.

As a general rule of thumb, purchasing policies tends to be less expensive the younger and healthier you are. A 55-year-old man in the U.S. can expect to pay an average long-term care insurance premium of $2,220 per year based on a 2022 price index survey of leading insurers that the American Association for Long-Term Care Insurance conducted.

However, most people don’t consider adding long-term care insurance until they reach age 62, when long-term care premiums can be more expensive.4

What are the pros and cons of long-term care insurance?4

Pros

- Having a policy can help offset some costs associated with long-term care, which may be appropriate for your financial situation.

- Certain policies allow you to choose where you receive your care, giving you more choices, including the flexibility to remain at home to continue aging in place with hired assistance.

- Depending on your coverage, if you choose to receive care at home, you can pay family members for their assistance instead of hiring someone from a home health agency.

Cons

- A long-term care insurance policy’s premiums can be expensive.

- Some policies don’t include at-home choices and only pay for long-term care provided in a facility.

- Some providers won’t cover a preexisting condition or illness.

- Some policies have an elimination period, during which you’re responsible for the total cost of your care.

- There’s no guarantee that the policy will be used, as not everyone will need long-term care.

What’s the right age to consider long-term care?

Generally, it’s better to consider long-term care in your 50s or early 60s before health issues arise that could make it more difficult or expensive to obtain coverage. However, the best age to consider long-term care varies depending on individual circumstances and preferences.

However, it’s important to remember that it’s never too late to consider long-term care. The premiums may be significantly higher, and coverage may be limited as you age, but paying the price may be the appropriate choice, depending on your financial situation.

What is the ideal profile of someone who would benefit most from long-term care?

While it’s important to consider individual circumstances and preferences when deciding whether or not to purchase long-term care, the ideal candidate tends to be someone who realizes the importance of having long-term care services if they’re needed.

You may want to consider a policy if you don’t have family members available to provide care or don’t want to be a burden on the family you do have. Consider exploring your choices if you have a family history of long-term care needs. Furthermore, if you wish to have the flexibility to choose care type and location, long-term care may be for you.

The Role of Geriatric Care Managers in Long-Term Care

Geriatric care managers are professionals who coordinate care for seniors, including physical therapy appointments, billing issues, nursing home stays, assisted living options, and other related needs. While they typically charge $50-$200 per hour, they can help families navigate senior care’s complex world and identify cost-effective solutions. Health insurance––including Medicare, Medicaid, or private health insurance––rarely covers these costs, so this service is usually an out-of-pocket expense for families.5

Preparing for Long-Term Care Expenses

- Start conversations early: Discuss your long-term care wishes with family and other loved ones, and consider speaking with a financial professional who understands the choices with extended-care services.

- Work with your attorney: Your attorney can help execute health care, general durable powers of attorney, and other estate documents.

- Organize important documents: Keep financial records, insurance policies, and legal documents up to date. Consider showing family members how to access the documents if you become incapacitated.

- Explore long-term care insurance: Policies may cover nursing home care, assisted living facilities, and in-home care. Generally, policies are difficult to purchase following a diagnosis.

- Set up a trust: Certain trusts can be helpful when communicating your long-term care wishes, but remember that using a trust involves a complex set of tax rules and regulations. Before moving forward with a trust, consider working with a professional who is familiar with the relevant rules and regulations.

Long-term care costs for seniors can be staggering and often unexpected. However, with proper preparation, you and your loved ones can be in a position to manage these expenses. Consulting with a financial professional who understands choices with extended-care services can help you better prepare for the future.

1 GLFPE.com, 2023

2 Insurance.CA.gov, 2023

3 Forbes.com, February 20, 2023

4 Administration for Community Living, 2023

5 PayingForSeniorCare.com, 2023