“85% of economists were predicting a recession last year. I was one of them. I felt uncomfortable being in the consensus, and it turns out being uncomfortable being in the consensus was actually the right feeling.” – John Mauldin, Mauldin Economics

“Heading into 2024, we want to own stocks, not because the FRB may cut rates or because inflation is heading lower. We want to own stocks because we are in a bull market and in a bull market that is what you do, you own stocks.” – Birinyi Associates, Inc.

“We would expect an institutional crises to become pronounced over this next year, even absent a disruptive major war, as routine political rage might materialize into something deeper.” – Geopolitical Futures

It is difficult to not feel a bit smug when the many predictions of early 2023 fell flat on their face. The call for recessions, market declines and interest rate bedlam fell on the ashes of irrelevance. Instead, we saw global growth, above average market returns and interest rate stabilization. Similar to a smooth landing at Des Moines International Airport on a sunny day the Federal Reserve and the American economy have managed to survive….and actually thrive.

Following a year of surprises, one wonders if the mood will turn dour. Inevitably a good year means we must have a bad one – right? Well, there are strong cases on both sides of that argument for 2024. Our view is that the economy and the investment markets are going through a wholesale change – one with higher interest rates, subdued growth and growing economic disparities. At the same time, everyone who wants to work (and spend money) can be accommodated. The old boss does not look like the new boss!

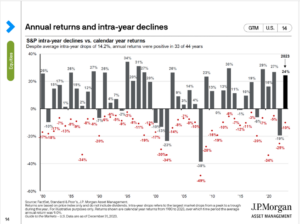

As I’m putting this together the roads are a skating rink and the temperatures are WAY below zero. Iowa winters are never completely predictable but they do have common characteristics. At least once a year we get a wicked blast of reality. Markets tend to also have common characteristics. This chart illustrates how markets behave in calendar years. The red dots are declines and they demonstrate how the stock market tends to have a period of intra-year negative returns. From there, many recover by year end. “Despite average intra-year drops of 14.2%, annual returns were positive in 33 of 44 years.” – JPMorgan. Barring major disruptions like COVID or the financial crises the ship tends to steady itself. This will be a lesson we want to hang onto this year.

I want to highlight three specific areas this year. First, how interest rates and the Fed are impacting our investments and planning. Second, we will dive into expectations for the year, and specifically, the election’s potential impact on the markets. From there I’ll finish up with some one-off thoughts around artificial intelligence and declines in higher education.

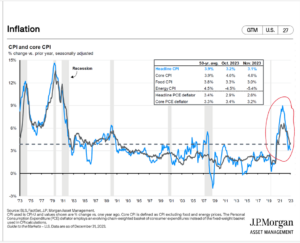

Don’t fight the Fed! Many investors have done their best to deny that the Fed’s actions will impact them by holding long term bonds or assuming cash will outperform the stock market. I think our credo should be modified to Don’t Ignore the Fed! Their influence on the markets, especially with their rhetoric and indications, cannot be denied. Every data point around inflation, Federal Reserve meetings and the follow up of their meeting minutes continue to move markets both directions. In 2024 a few things have become clearer. One – inflation hit a peak:

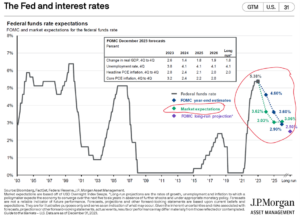

Does this mean that inflation is going to remain muted? What might happen to prices if we do have a recession? These issues are why we won’t want to ignore the Fed. Inflation, historically, can be like a pesky younger sibling and stick around. It is also disparate – energy prices are declining, however food prices remain elevated. If inflation was to surprisingly begin to rise again the Fed would likely need to react by raising interest rates. As you can see from the chart below – this is clearly NOT what the market is expecting.

If the market does not get what it wants (primarily lower interest rates) many of the recent stock market gains, particularly in Big Tech, would likely retreat. We choose not to ignore the Fed this year but will invest in a manner that allows for some surprises. Like our lovely Iowa winter, the polar vortex occasionally reminds us who is boss.

Let’s take a look at expectations for the year.

“There is no more reason to expect the herd’s optimistic market calls for 2024 to be closer to the mark than those of 2022 or 2023. While the “group stink” feeding those forecasts may not qualify as a leading contrary indicator of what we should expect this year, the upbeat consensus forecasts should definitely be taken with a grain of salt.” – Doug Kass

We have been going through some seismic shifts. Primarily what we are seeing now is the economy and the markets adjusting from the pandemic. Its impact on the things we hear about in the media – higher rates, higher inflation, and worker shortages all stem from the pandemic shock. This has lead to a regime change – one with higher rates and likely, more volatility. It also, in my opinion, creates an opportunity for quality investment management to add value.

In our recent YouTube interview with Eric Lynch from Scharf Investments we explored the values in value investing. Working hard to pay the right price for stocks is a discipline that has paid off over time. We remain in a secular bull (upward trending) market. This means that while there will be pullbacks along the way, the overall trend is higher. One must stay invested in these markets to get the returns that will eventually prove elusive when things shift to a secular bear (down) market. If we knew when this shift was going to take place, we could gather our pennies and head to a permanent vacation (somewhere warm please). For now, we need to acknowledge the present trend. It lends itself to more active portfolio management and active rebalancing. This is what our team does on your behalf at PrairieFire.

Shifting our attention over the bond/fixed income market we see a different picture. If interest rates come down, bond prices will go up. The opposite is, of course, also true. For the time being we can get short term yields at levels we have not seen in decades. This makes shorter term bonds and CD’s more attractive. That will likely persist unless we see a turn in rates either up or down. “We overall prefer short-term bonds over long term. That’s due to more uncertain and volatile inflation, heightened bond market volatility and weaker investor demand.” – Blackrock

As we gaze into 2024 there is one big question that cannot be ignored – Does the election matter for investments?

Yes……and no.

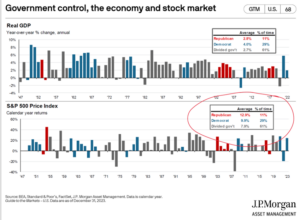

Note the area that I’ve circled above. Most of the time we have divided government and since 1947 that’s led to moderate returns. The difference between political parties in power is marginal. The election cycle could lead to volatility, however, as markets digest expected policy over the political leaders expected to win. Polling results and policy proposals during the campaigns could drive short term upset. In my opinion, changing investing opinions based on an election is unlikely to be rewarded in the long term. Now that all the candidates have left Iowa we can all enjoy a brief respite from the political ads and the busy restaurants in the East Village! 😊

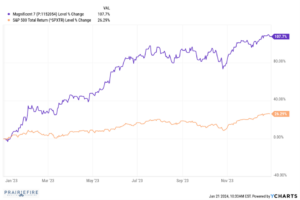

We have displayed this chart ad nauseum. The largest 7 stocks in the index that comprises the top 500 stocks in America were responsible for a large part of the overall returns in the market last year. One of the primary reasons the market bid them up is their exposure to trends in artificial intelligence. This new technology has all the fervor that we saw during the internet revolution in the early 2000’s. Chat GPT and other applications have made data easy to access and research times have been greatly reduced. I asked the Jasper AI application – why is artificial intelligence such a big deal?

It gave me these 4 reasons:

- Efficiency and Productivity Boost

- Personalization and Customer Experience Improvement

- Predictive Maintenance and Data Analytics

- Societal Impact and Technological Progression

It then detailed some of the risks:

‘While AI is tremendous potential, it also poses significant risks to companies and society when bad actors use the technology for malicious purposes, like deep falsification or cybercrime. Another risk is the potential for AI decisions to be biased and therefore unfair. “ – Jasper AI

There is clearly a strong investment case in this technology. However, when things are shiny and new investors and humanity in general tend to overpay. We want to be part of this growing trend with prudence around allocations that would add unnecessary risk.

Let’s briefly shift gears to a big-ticket item in many homes – college education. From congressional testimony around free speech issues to declining enrollments it has become clear that the pandemic started a ball rolling in higher education that may prove difficult to slow down. Many are wondering if colleges are delivering enough value for their sticker prices. Sticker prices that are neither transparent nor fair in many cases. Will did some research and explained to me – “There is already a major decline in demand for colleges as enrollments have been down by 4 million students per year since 2010 (even with population growing by 30 million.) There are middle and high school students that are being taught by AI. Colleges are not far behind. Tuition costs are beginning to fall putting more power in student’s hands.”

In summary, this year holds both a lot of promise and, as always, some risks. Geopolitical events along with our own election cycle are likely to cause intermittent volatility. However, if the job market stays strong and the consumer continues to spend money with confidence, we could continue to see the economy grow. For that reason, we continue to encourage clients to stay invested and use last years growth in growth to rebalance to less expensive areas in the market including energy and stocks outside of the United States.

Thank you for being part of PrairieFire. We are excited to share this exciting new year with all of our clients and friends. Giddy up!