Technology is great, until it isn’t.

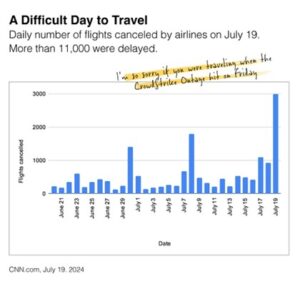

Many were concerned about the computer outage that affected everything from travel to doctor’s offices to bank and investment accounts and reached out to share your concerns.

It was a bit of a relief when cybersecurity firm CrowdStrike’s CEO George Kurtz reassured us early in the day by saying, “this is not a security incident or cyber-attack. The issue has been identified, isolated and a fix has been deployed.”1

Still, it’s upsetting to log into accounts and see a warning message. Here’s what Charles Schwab had on its customer portal for most of the day.

“Due to a third-party, global and industry-wide issue, certain functionality may be intermittently slow or unavailable. We’re monitoring the issue. Phone services may be disrupted and hold times may be longer than usual.” I can tell you firsthand – the phones were very, very busy!

Many were wondering what they should do during this type of disruption. Unfortunately, there’s not too much in this type of situation. It’s a reminder to stay proactive with personal security, like updating passwords. Also, it’s a reminder that certain accounts have limitations regarding financial protections.

Remember, with bank accounts, FDIC provides depositors with an insurance payout of up to $250,000 per depositor, institution, or ownership category. If you have more than $250,000 at a bank, we might want to take a look.

(As you may recall, when Silicon Valley Bank and Signature Bank had issues in March 2023, there were concerns about the treatment of depositors. Fortunately, the FDIC stepped in quickly and guaranteed all deposits, even the uninsured money.)

As far as we know everything is up and working. However, please let me know if you’re struggling to get updated information on your financial accounts. Stay cool – it’s a hot week just about everywhere!

1. CNBC.com, July 19, 2024. “Microsoft-CrowdStrike issue causes ‘largest IT outage in history.’”