Changes are coming to the complicated form that students must submit to qualify for college financial aid, known as the Free Application for Federal Student Aid (FAFSA).

The Department of Education is calling it the “most ambitious and significant redesign of the federal student aid application in decades” and adds that it “includes unprecedented changes to how students and families apply for federal student aid and how we determine eligibility, giving students a better and simpler experience with the FAFSA form.”1,2

What Is FAFSA?

A FAFSA form allows a college-bound student the opportunity to apply for federal student aid, such as federal grants, work–study funds, and student loans. Submitting the FAFSA form each year is free, and it gives students access to the largest source of aid to help pay for college or vocational school.3

In addition, many states and colleges use the student’s FAFSA information to determine state and school aid eligibility. Certain private aid providers also may use FAFSA information to determine whether a student qualifies for assistance.

Even if you don’t think your family will qualify based on your income, your child should consider submitting a FAFSA form each year to provide financial flexibility.

FAFSA Deadlines

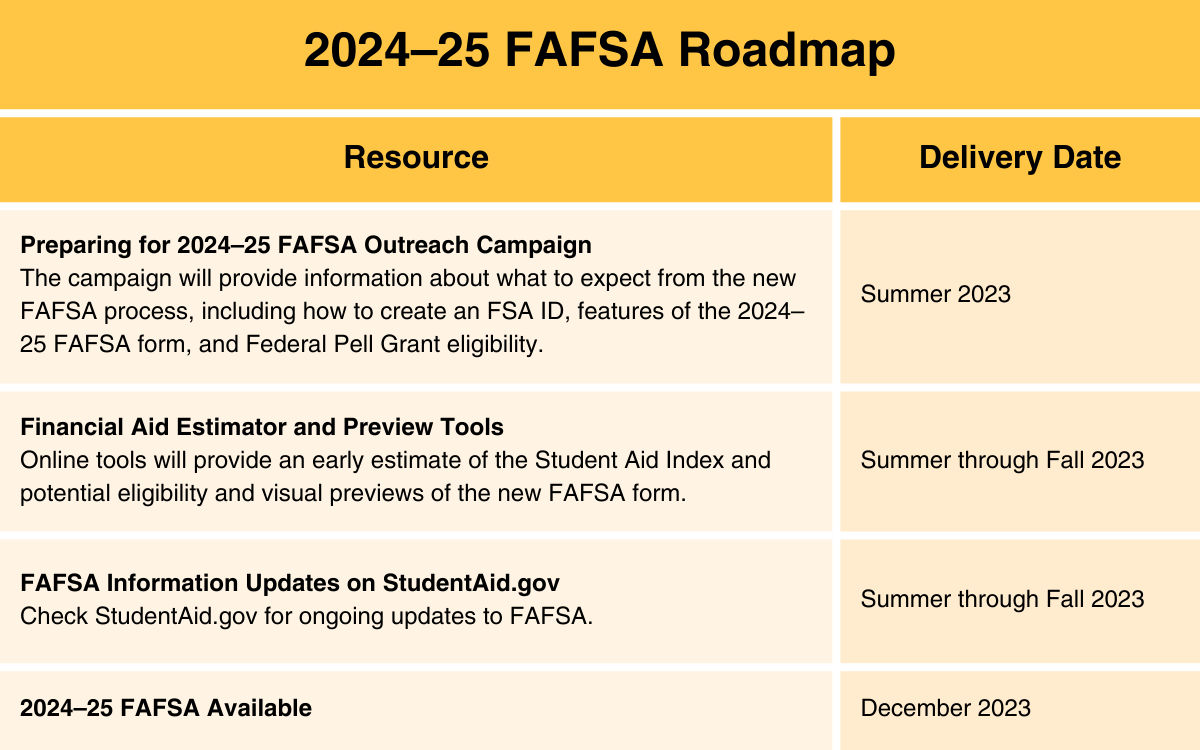

The FAFSA is typically released on October 1 of each year. However, the U.S. Department of Education announced that the 2024–2025 school year form won’t be available until December 2023 due to all the proposed changes.1

Many states and colleges use the form to determine scholarship aid, and some programs award the money on a first-come, first-served basis until available funds are depleted. So, you should consider completing the FAFSA as soon as possible after it becomes available. A list of deadlines for both federal and state aid programs is available on the Federal Student Aid website.

FSAPartners.ed.gov, March 21, 2023

What Is Changing in the FAFSA?

One of the main goals of the FAFSA overhaul is to make it simpler to complete. The revised version of the FAFSA asks 46 questions compared to the prior version’s 108 questions.1

Besides making it easier to complete, there are several other changes to the FAFSA for the upcoming year that may or may not benefit your students. In general, the new approach will be most favorable for lower-income students and less ideal for families with multiple children in college, small businesses, and divorced households.

Here are some highlights of the new FAFSA:1

1. Expected Family Contribution

The term Expected Family Contribution (EFC), which refers to how much the federal aid formula believes a household can pay for college, is being changed to the Student Aid Index. This change is mostly cosmetic.

2. Multiple Students in College

The FAFSA overhaul will remove the benefit for families with more than one child in college. Traditionally, parents were given a 50% break on their EFC with two children in college, and the discount increased to 66% with three children. This change attempts to level the playing field since the discount wasn’t fair to families with only one child in college.

3. Small-Business Owners and Family Farms

The new FAFSA removes a benefit that favors small-business owners and family farms. In the past, these individuals could exclude their business and farm assets from the FAFSA if they did not employ more than 100 full-time employees. That exemption will no longer exist. Going forward, a household’s Student Aid Index will depend on a family’s adjusted gross income and the value of the business or farm.

4. Divorced Parents

The traditional formula made it easy for the custodial parent to be the one with the lowest income and assets. In the past, the custodial parent, who completes the FAFSA, was the one with whom the student lived most of the 12-month period ending on the day that the FAFSA was filed. With the new formula, the parent who has spent the most money on the child will be the one completing the FAFSA. However, child support will be reported as an asset rather than as income, reducing the impact on a student’s financial aid eligibility.

5. Grandparent Contributions

The new FAFSA is good for grandparents and others who want to help with a student’s college costs. Starting with the 2024–2025 school year, qualified distributions made by grandparents, aunts, uncles, and others from qualified college savings programs will no longer be taxed as a child’s untaxed income, which traditionally has been assessed at 50%.

6. Lower-Income Students

The federal financial aid formula is expected to be more generous to lower-income students. The changes may allow an additional 1.7 million students to qualify for the maximum Pell Grant, the federal program for low- and middle-income students.

Paying for College

Paying tuition and other educational costs for your children or grandchildren may seem a bit daunting, but it may be more manageable with some preparation.

It’s important to remember that while college is expensive, few students pay the full sticker price. College costs have doubled in the past 30 years, but so have the financial aid packages and merit scholarships that colleges give students.4

One of the most substantial changes introduced by the TCJA was the qualified business income deduction, which allowed for a tax deduction of up to 20% of business income for sole proprietors, LLCs, partnerships, S corps, trusts, and estates. The main reason for this deduction was to match the large (and permanent) C-Corp tax rate reduction that was also put in place under the TCJA. Taxpayers with AGIs below $170,050 (single) or $340,100 (married) qualify for the full 20% deduction with a complete phase out at $220,050 or $440,100, respectively. If not extended, this provision will go away as of 2026.

We’re Here to Help

We have helped many clients create college strategies for their children and grandchildren. It’s one of our specialties and a rewarding aspect of the services we offer. If you want to learn more about how to start preparing for college costs, please contact us. We have illustrations that show the pros and cons of the different college-saving choices.

1 WealthManagement.com, May 1, 2023

2 FSAPartners.ed.gov, 2023

3 StudentAid.gov, 2023

4 BestColleges.com, April 11, 2023